Fun with Inflation Expectations

I recently wrote about the Federal Reserve’s (Fed’s) lack of credibility[1] and explained that monetary theory today generally views long-run inflation expectations as being set by the Fed’s “forward guidance”. That is, the Fed simply announces future inflation and because it is credible, markets believe it and act accordingly. What markets expect eventually becomes reality.

Modern central banking believes – and develops its theoretical models on the assumption that – it can use forward guidance alone. Simply announcing future inflation rates will nail them down[2].

If central banks were people, we might politely say that the think a little highly of themselves.

So, I thought, for fun, I’d just imagine this is 100% true. In that case, we can look at current inflation and expected future inflation and glean which central banks around the world are considered credible by the market.

All the numbers I use below are taken from Trading Economics which includes a “Forecasts” tab (just click that, then the country you want to find this data: https://tradingeconomics.com/forecasts ).

Our Leading Central Banks

Everyone knows that the central banks in the “developed economies” like the US, UK, and Europe are the most professional and therefore credible. We would probably include Canada, Japan and Australia in that category too, but let’s start with the clear leaders first.

This shows the forecast performance for our three leading central banks: the US Federal Reserve, the European Central Bank, and the Bank of England. The first column shows inflation today. Then it shows the current forecasts for the next year, ending with 2023 Q4.

Now, I’ll be honest, I don’t know exactly where they get these forecasts from. I looked at several different forecasts and different estimates. The Trading Economics forecasts don’t seem to be very different from the numbers I found on my own, so I’ll just use theirs.

In any case, if the measure of credibility is how much the markets expect the central bank can get inflation down over the coming year, the US Fed wins! According to this, within in one year, inflation will be less than 2%! That’s amazing and better than even the Fed itself claims[3].

The far-right column calculates the percentage change from today to the end. So, the market is expecting a 77% decline in US inflation. Way to go Jay Powell and team USA!

The ECB is clearly next most credible. That’s no surprise. The ECB was built around a tradition of German reliability coming from the late, great but exceptionally credible, German Bundesbank which ruled over low German inflation until the ECB was born. They even put the ECB headquarters in Frankfurt to inherit German monetary credibility.

Lastly, and sadly so, our British friends don’t perform so well. The UK is clearly less credible, only getting inflation down to 6.4%. Sad, really.

We have two clear credibility leaders. The US is the most credible and hence gets inflation to drop the most! The ECB is next with its vast control over European inflation. Markets clearly hold each institution in awe.

But wait… if the ECB is so credible, then…

If the ECB is a bastion of credibility, why aren’t France and Germany expected to do better? They are both Euro countries and under the ECB’s umbrella. So, if simple forward guidance - pronouncements from on high - pin down long-run inflation expectations, I would expect inflation to fall by as much in those countries too! It doesn’t.

OK, so France starts from 5.6% and so a 70% drop would be a lot to expect. But at least the French get to 3.6%.

But the Germans? Wait…what happened there? German inflation is 10% today and yet only drops to 6.5%. That doesn’t make any sense. It must be the Germans are facing unique energy or war-related challenges.

Maybe other Europeans are in the same boat. So let’s look at countries bordering the Ukraine war[4].

Hungary and Slovakia are both landlocked and therefore have no other option for their energy. Surely they are worse off than Germany over the coming year!

Nope! Hungary too is expected to miraculously lower inflation from its current 15.6% to 4.5%, a 71% fall in inflation! Wow. The Hungarian Central Bank must be super credible and they don’t even have the Euro!

Even the Romanian central bank is expected to lower inflation by 58% over the year! And the Germans can only do 35%? German credibility must really be …. Err… I mean ECB credibility – since Germany is in the Eurozone and is home to ECB HQ – must really be shot.

I guess the right interpretation is that the ECB is credible (dropping inflation by 71%) but Germany is less credible than Hungary, Slovakia and Romania. But that makes sense because they aren’t under the ECB and can act on their own!

Oops… Slovakia uses the Euro. Oh, so Slovakia too is under the ECB. Basically Slovakia’s in a case similar to Germany. It uses the Euro and is heavily affected by the energy crisis. Of course Slovakia is additionally landlocked and tiny, so you’d expect it to perform worse than Germany. But no. It is better. Hmmm.

Rethinking the Stories

Ok. So the story is that Trump…I mean Biden messed up…err…wait, neither of them are in Europe. Let me start again.

Ok. So, the story is that inflation is out of control. But we are lucky because central banks are so powerful and everyone in the market knows this and they can totally control inflation. And, we can see that in the numbers. In all these cases, inflation drops like a rock next year.

Let’s appreciate that good news first. We aren’t sure how or why, but inflation drops and basically disappears next year everywhere in the world. I mean, except Germany, but in credible economies like Hungary and the USA, it’s essentially gone.

Why and how? Easy. The US Fed is very credible. Markets believe anything it says because it’s nearly perfect in every way. Forget that silliness when it claimed inflation was “transitory” last year. Now and going forward, Fed officials are basically speaking from Olympus.

And, the foundation of modern monetary thinking is that they control long-term inflation expectations via their mere pronouncements, called forward guidance.

What About the Aussies?

Australia and New Zealand both adopted inflation targeting regimes in the 1990s. That meant that, among other things, their parliaments voted on inflation targets that their central banks were required to meet. This allowed them to become super credible.

In both countries inflation drops like a rock, more in New Zealand (by 52%) but they start from a higher number and both hit 3.5% in 12+ months. Amazing what credibility buys you!

And Now For Something Completely Different

In international monetary economics, you learn to check what is happening in Latin America. That’s sort of like the macroeconomist’s experimental ground for monetary policy.

Surely no one expects their inflation to drop like it does in the illustrious examples given so far.

Wait a minute! Chile drops inflation by 71% just like the ECB?! That can’t be right. I mean the ECB is headquartered in Frankfurt. And, I mean Frankfurt, Germany, where Germans live, not Frankfort, Alabama. Okay, I did say the Chileans were good central bankers.

But if this longer-run inflation success is any indication of credibility, like modern central banking thinks, then markets and forecasters see all these countries as having more credible disinflation plans than Germany.

Before I move on, I have to ask the following. On what basis do they expect Argentine inflation to go from 78% up to 116% then drop like a rock by more than half in two quarters? I’m having fun here, but that’s just absurd. It can happen. Don’t get me wrong. I’d just like to see the deep analysis suggesting this is the actual, likely path for inflation in that country.

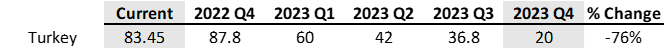

Oops. How did Turkey get in here? It’s not in Latin America and not in Germany. Hmmm. It does apparently have a very credible and talented central bank though! The Turkish central bank is clearly going to lower inflation from 83% today down to 20%, a 76% drop… beating the ECB!

We all knew we could actually trust the Erdogan government. Here’s the proof! Way more trustworthy than the Europeans. Turkish team 1, ECB team 0. Turkey wins by 5% points!

The Golden Elite and Overall Ranking

So, what if we rank all these countries by that % Change? How do those rankings shake out?

We now have a Golden Elite Club. The market views the most credible central banks today as being the US Federal Reserve followed by Turkey, then Hungary and finally the ECB and Chile. Nice club. That’s totally believable.

Those with Silver Status include Mexico, Slovakia (an ECB country), Romania, Brazil, New Zealand, Argentina and Australia. Also a very natural collection of countries based on very similar central banking policy and history.

Finally, the troubled countries are clearly France, the UK and Germany. I knew it! Well, I always suspected it somehow. In any case, their finance ministers and central bankers should probably visit Turkey for a few weeks to study best practices.

What About Inflation Targets?

What about inflation targets, you ask? True, I did mention them. Most countries have them. And there is a real flaw in my above analysis. That is, central bankers will all tell you that 12+ months is really medium term and their pronouncements – aka “forward guidance” and credibility – controls long-term inflation expectations. So my analysis is admittedly a little off. Inflation targets are traditionally “medium term” objectives so maybe comparing expected medium term inflation to them is a better measure[5].

So, I pulled each country’s inflation target. Argentina no longer has one, so I dropped them. Then I calculated who gets closest to their target by 2023 Q4 and ranked them that way.

The first column is current inflation, the second is the 2023 Q4 forecast. Then comes the central bank’s stated inflation target. Finally, I take “2023 Q4 minus the target” and I rank the countries based on which one will be closest to target over the coming year.

The USA wins again! I promise I did not mess with the numbers.

Next is the Mexican central bank, followed by the ECB. Those top three form our new Golden Elite Club.

Those with Silver Status are now Chile, Brazil, New Zealand, Australia, Hungary and France.

Finally the problematic countries. Sadly Germany and the UK are still there, now joined by Romania, Slovakia and the formerly illustrious (according to my earlier ranking) Turkey. A year from now when German inflation exceeds Slovakian inflation, although both are under the ECB which will have achieved 2.9% inflation for most the other countries, we’ll remember this analysis!

Winding Down and Some Lessons

What’s the point of all this? Well, honestly, we need more things in the world to laugh at today. These are sad times and political times. We need to smile.

All the numbers I use are real. Every economic thing I mention is right. But I was having fun and I do not really believe these rankings have any meaning. If anything, I now trust the forecasts being published much less in general.

Traditionally in international monetary economics we study what are called “nominal anchors”. Those are the key metrics people use to see what inflation will be in the long-run. They are things like: fixed exchange rates, money growth rates, or even interest rates. Those are things central banks actually can control. Maybe they should, maybe they shouldn’t, but we know they can.

The dominant idea today is that central bank’s control long-run inflation expectations by forward guidance. Literally, their word and their credibility. We should be skeptical of this in its strongest form.

What I hope my little fun here did was highlight a few things:

I hope it made fun of the idea that somehow central bank credibility is performing magic. Forward guidance matters and credibility matters. Inflation targeting regimes and fixed exchange rate regimes are means of institutionalizing credibility. They are laws and contracts forcing the central bank to maintain a certain inflation rate. Jay Powell saying he wants to be more like Paul Volker (Fed chair in early 1980s) is not.

If all the forecasts are right, then the overwhelming conclusion is that inflation will fade away next year. Period. That seems to be the case for ALL the countries with a very few exceptions. Even Turkey and Argentina, where inflation is truly out of control, are expected to get inflation under control relative to today. If that’s true, then inflation is going to fall largely independently of what all these central banks do or say. If that’s true, then it’s not brilliant Fed policy or credibility controlling inflation. It’s not even the central bank! Or, all central banks have suddenly obtained super powers and we should watch for the next DC or Marvel movie starring Jay Powell and Christine Lagarde.

It’s not just happening to you. This is why I made the joke blaming Trump, then Biden. In all our individual countries we interpret the data to blame the other team. But it’s still all inward looking. Yes, in the US, President Trump and Congress’s giant spending package in 2020 and President Biden and Congress’s giant spending package in 2021 are both likely drivers of US inflation today. To the extent that happened in other countries, it’s driving it there too. The same thing is happening everywhere. That doesn’t mean we don’t need our local governments and monetary authorities to slow spending, get budgets under control and the like. It just means we have to look around and take the lessons everywhere to heart. For example: If it’s high debt to GDP driving inflation, Japan should have the highest inflation. Debt to GDP is 266% (it’s about 100% in the US) but inflation is only 3% in Japan. … My point is simply that we need to think hard about these things and be honest in evaluating our own favorite pet theories.

Our current monetary system and thinking about monetary systems is off. I don’t think we deeply understand monetary economics anymore. I don’t believe we understand what determines long-run, steady state inflation. We think it’s credibility and announcements. I think that’s wrong. At least it’s not the sole determinant. Credibility is a pre-requisite. It may be a necessary but not a sufficient condition for long-run inflation determination.

[2] There are two standard assumptions in modern macroeconomic monetary models. One is that inflation in the long-run is pinned down by the growth rate of the money supply. Modern central bankers generally deny that publicly. The second one is that inflation in the long-run is pinned down by forward guidance. See John Cochrane’s blogs for more detailed discussions of these assumptions and their implications: https://johnhcochrane.blogspot.com/2022/09/expectations-and-neutrality-of-interest.html . Bottom of page 8 of his paper (https://www.johnhcochrane.com/research-all/inflation-neutrality ) states: “The central bank threatens hyperinflation or hyperdeflation in order to select, or “coordinate expectations” on the equilibrium it likes. The Fed simply announces its inflation target, announces this threat, and inflation jumps to whatever value the Fed desires.”

[3] The Federal Reserve’s own forecast is that the US will have 3-3.4% core inflation in 2023 and 2.2-2.5% in 2024. See “Core PCE inflation” here: https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220921.htm

[4] I could have included Poland too. Just so you know, it’s inflation today is 17.2% and is expected to drop to 7.5% by 2023. That’s a 56.4% drop.

[5] By the way, most of these countries had 2% targets but they’ve raised them recently. Some people have suggested the US Fed also raise its target. Thankfully, they’ve said (essentially) “that’s cheating”, which it is, and resisted the temptation to date. I sincerely hope they hold out and don’t raise our target. As much as I’m making fun of all this, it would be a sign of defeat and really destroy credibility. That really would be bad, in my opinion.