Global Economics Companion Site

Hi All,

Thanks, as always, for reading my columns.

When I set out to write this column, I thought I could treat Substack like a website/news site, but that’s not quite how it works. Initially I tried to post reports from my team but either I had to email them or I posted them and no one knew they were posted.

I do have a student research team at Quinnipiac University, where I teach, and they produce weekly reports on a few different topics. And this started with that team in 2016 or so (see bottom of About US tab …link in a minute) and I wanted to be able to write more while also posting their work. But one site doesn’t get it all, so we branched out.

New Global Economics Companion Site

Substack will remain where I write columns but for weekly reports and eventual monthly reports and possibly deeper analysis, we launched the (largely) student-run site. Please check it out: https://www.globaleconomics.net/

I’ll pull from that site for some columns and I’m very proud of the work these students do. You can check out the past and current teams here: https://www.globaleconomics.net/about-us

I plan to update that page with a picture and info of the Spring 2024 team. My goal is always to have overlap of the teams, with experienced members helping new members. Experienced members then help edit or develop new reports as well. And, I like having the long record of teams and students in part because I’m a sentimental wimp who loves to see all the great students and subsequent friends I’ve had over the years, but also for the students who can then reference the site applying for jobs.

Weekly Reports and Current Plans

The weekly reports they produce are mostly on exchange rates at the moment. We break everything into three broad regions of interest: Central Europe, Trans-Atlantic area and the Pacific region. We currently produce short reports that allow us to track a few countries regularly.

We have a Central European (CEE) interest rate report as well, but interest rates are hard data to get that’s consistent and comparable across countries. The CEE region joined the EU and had to agree on interest rates to be “official” for certain EU reasons, so they have rates that are comparable. But we’d like to shake up this report and also offer interest rate reports for the other regions.

We only use publicly available data. If anyone has suggestions, let me know. We currently pull from Eurostat, FRED and the IMF, often using DBnomics.

The idea of interest rate and exchange rate reports to start is that interest rates are drivers of exchange rate movements (higher interest rates usually strengthens a currency). Interest rates are also important for inflation and economic performance (higher interest rates usually slows an economy and lowers inflation).

So, exchange rates and interest rates are two key reports. You can that, around interest rates, I built exchange rate reports but explain they move “the economy” and inflation too. So those are my next targets. The problem is inflation is usually monthly data and “the economy” (i.e., GDP) is quarterly.

That brings us to the other challenge for the team. I need team members to produce something weekly. This is important for their experience, development and from a management perspective. So… we’re always looking for good and interesting daily data. Any and all ideas are welcome!

All that’s to say, we hope to have another report or two soon that we post weekly. Then, this semester, we aim to release monthly reports that build on the weekly ones and have additional information (a lot more data is available monthly). Probably we can start with inflation and unemployment (another key factor of “the economy” and it’s reported monthly). We are also releasing a table of current data for each region. You’ll see the first version on the Trans Atlantic site and the Pacific Region site of globaleconomics.net. We need to clean it up a little and then we’ll have it for all sites. Step one was to get a student to code it to grab the data, organize it and get it onto the site. That’s now done.

The goal is to have a site that covers a few key regions of the world and has simple, informative economic material on those regions. Again, I have an educational focus, so I want a project where I get to work with good students and they get to grow and learn. In this same, educational spirit, we also try to post our data sources, links and other articles of reference and will post all our code. Anyone should be able to replicate our empirical work at any time.

We are also experimenting with using ChatGPT to edit. We want to write and think ourselves, but it’s hard to find student editors and the last two weeks of reports we wrote, then we asked ChatGPT to edit (not write) and it worked. It caught typos, grammar and smoothed language in some cases. Hmmm… Interesting….

Finally, if you look at the latest reports, you’ll see why it’s interesting to track things regularly. This week’s reports show declining exchange rates for the Trans Atlantic countries and the Pacific ones. Those are all those local currencies compared to the US dollar. That means the US dollar must be strengthening against many currencies. Interesting… I wonder why.

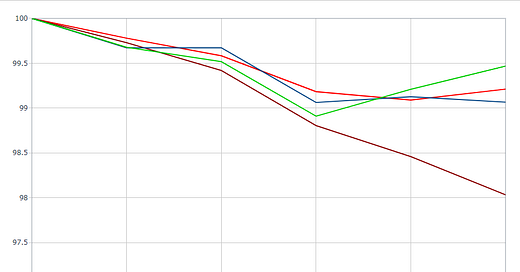

Trans Atlantic Region

Here are the “Trans Atlantic” rates: CAD - Canadian dollar, CHF - Swiss franc, EUR - Euro, and GBP - British pound. We define them as “domestic currency per USD” and declines imply a weaker domestic currency, hence a stronger USD.

Pacific Region

The movement is even more pronounced for the “Pacific Region” countries: AUD - Australian dollar, JPY - Japanese yen, KRW - Korean won, NZD - New Zealand dollar.

If I just saw this pattern for Trans Atlantic region and not the Pacific, I’d think it’s the economic slow down in Europe that I’ve been reading about. But, when it’s in two, very different regions, then it’s rather a stronger US dollar.

I’m not 100% sure what happened last week to drive that. Perhaps it was that market participants were seeing the Fed as less likely to cut rates as soon and as much as market participants expected. That would act a little like a mild increase in the US interest rate, strengthening demand for US dollars.

Anyway, the benefit of seeing weekly reports is that you start to notice trends and, for me, those are things to investigate. The teams’ reports often inspire me to dig into a topic and that leads to some my columns for sure.

Closing

That’s all for now. I just wanted everyone to know about the site. I hope to have more and better reports soon and I’ll see if there’s a way, maybe monthly, to share with you the highlights from the team. I don’t want to overwhelm you, but I want you to benefit.

I’ll definitely send a note when I get pictures and information on the new team. I’m very proud of their work and work-ethic - it’s totally the opposite of what you read about the new generation, these students work at jobs, study, take extra classes, extra majors! and still volunteer to do this…really amazing - and I’d like them to get the credit and recognition they deserve.

Thanks again for reading and supporting my efforts. I look forward to comments and suggestions for topics of interest, economic questions you want answered, and the like.

Sincerest best wishes to you all,

Chris