By Philip Caldarella, Quinnipiac Global Economic Research Team

Edited by Chris Ball

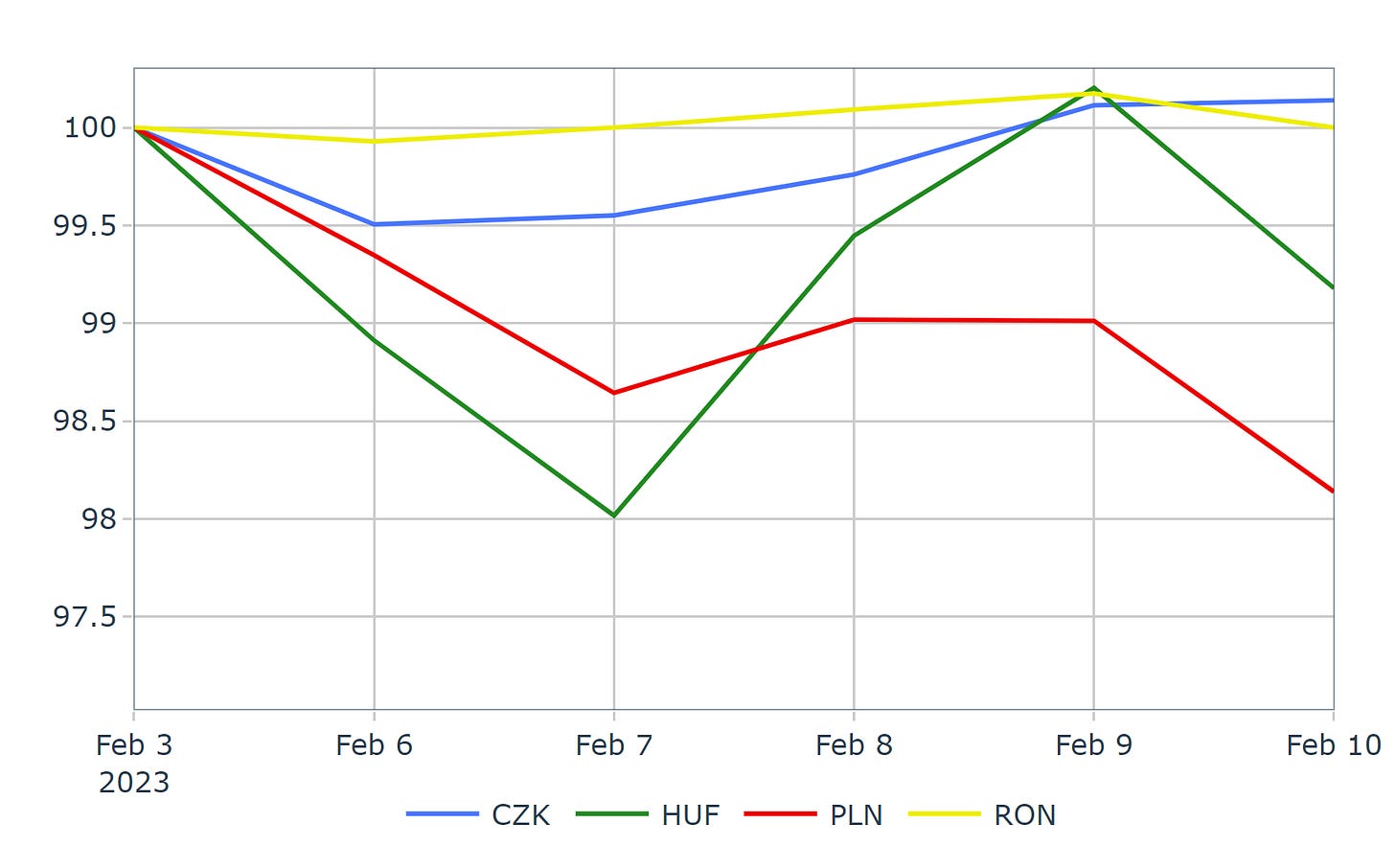

CEE Currencies Index

Source: Eurostat and own calculations. Exchange rates are inverted to be Euro per local currency (i.e., an increase indicates a stronger domestic currency) and then indexed to 100 at the start of the period.

For the week of February 6 – February 10, 2023, the CEE currencies remained largely unchanged or moved slightly weaker relative to the Euro. All the currencies weakened at the beginning of the week. The Czech koruna (blue) was the only currency to post a small gain of 0.14% by the week’s end. The Hungarian forint (green) and the Polish zloty (red) closed the week 0.82% and 1.86% lower respectively. The HUF was able to recover some of its midweek loses while the PLN continued its worsening downward trend. The Romanian leu (yellow) stayed nearly flat.

CEE Currencies Historical Trends

Source: Eurostat and own calculations. Exchange rates are inverted to be Euro per local currency (i.e., an increase indicates a stronger domestic currency). The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

For the week of February 6 – February 10, 2023, the Czech koruna (CZK) continued its three month upward trend. The Hungarian forint (HUF) fell some this week but clearly was still in its recent upper range. The Polish zloty (PLN) experienced a large drop this week that pulled it considerably below its lower bound despite its relatively consistent movement in the past three months. The Romanian leu (RON) finished the week at its upper bound. The RON continued to fluctuate substantially about its mean.

The Czech koruna continued to push higher as it has been doing for the past three months. The Hungarian forint’s upward trend might be slowing but it is too early to tell. The Polish zloty’s three-month stability seems to have come to an end. The Romanian leu’s significant fluctuation led to no clear emerging patterns, at least not yet.