By Philip Caldarella, Quinnipiac Global Economics Team

Edited by Chris Ball

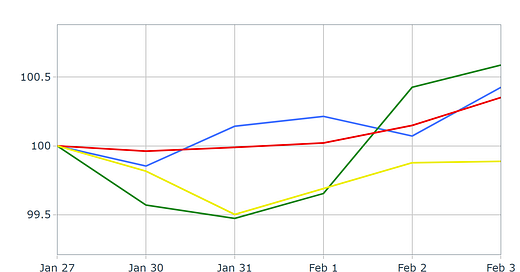

CEE Currencies Index

Source: Eurostat and own calculations. Exchange rates are inverted to be Euro per local currency (i.e., an increase indicates a stronger domestic currency) and then indexed to 100 at the start of the period.

For the week of January 30 – February 3, 2023, all the CEE currencies but the Romanian leu strengthened relative to the Euro. The RON (yellow) weakened significantly at the beginning of the week but regained some losses to close the week only 0.11% lower. The Polish zloty (red) strengthened consistently throughout the week closing 0.35% higher. The Hungarian forint (green) started the week slow with a 0.5% drop. However, by the end of the week the HUF posted a large gain of nearly 0.6%. The Czech koruna (blue) fluctuated throughout the week but ultimately finished over 0.4% higher.

CEE Currencies Historical Trends

Source: Eurostat and own calculations. Exchange rates are inverted to be Euro per local currency (i.e., an increase indicates a stronger domestic currency). The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

For the week of January 30 – February 3, 2023, the Czech koruna (CZK) continued its three month overall upward trend. The Hungarian forint (HUF) saw a large strengthening as well. The Polish zloty (PLN) has risen this week close to its average. The PLN has fluctuated significantly between its upper and lower bounds in the past three months. Lastly, the Romanian leu (RON) has finished the week close to its upper bound. However, the RON has fluctuated substantially about its mean. It has been above and below its upper and lower bound multiple times in the past three months.

Hungarian forint and Czech koruna continue their clear upward trend. The Polish zloty has shown stable movement about its mean. The Romanian leu’s large inconsistency leaves no pattern evident.