The Employment Enigma and the US Economy, Part Two: Unemployment

This is Part Two of my series on employment and the US economy. This first part deals with labor force participation rates (link here). This second part focuses on unemployment.

The latest US jobs report[1] came out Friday, August 5th, and said we’re at 3.5% unemployment which would be historically low. If that’s true, then the US economy is extremely strong right now and the Fed should not worry about raising interest rates. The economy can take it.

That, of course, seems to be the fear on Wall Street where no one wants Fed rate hikes. They like a world with cheap, easy money. If the economy and unemployment are weaker than the numbers suggest, then the Fed might not hike rates as fast and as much.

Labor Force Participation Review

Recall from the last column (link here) that we imagined an economy with 100 people in it. Twenty of them weren’t working. They were called “not in the labor force”.

The other 80 people were thus called “in the labor force” or simply referred to as “the labor force”. And we took the “labor force” (80), divided it by the total population (100) to get an 80% labor force participation rate[2]. That all led to a diagram like this.

Understanding Unemployment

Continuing from there, we start with the 80 people, aka “the labor force”. Now these are all the people willing and able to work. Notice the “willing” piece means they are trying to work or are working. We’ll discuss what happens to those not willing to work in a minute.

Of those 80 people, suppose 75 are working and 5 are not. As long as those 5 are still “willing” to work, then they are counted as “unemployed”[3]. The other 75 are clearly working and hence called “employed”.

Now we have a diagram like this.

The unemployment rate is just the number of unemployed (5) divided by the labor force (80): 5/80 = 0.06 or a 6% unemployment rate, in this example.

The actual US numbers are: 332 million population with 206 million in the labor force and 7 million unemployed. So our actual unemployment rate is 7/206 = 0.03 and if you use more precise numbers[4], you get 0.035 or 3.5%, which is the number reported.

The Effect of “Not In the Labor Force” on Unemployment

Let’s now imagine that 1 of the 5 unemployed people in our example gets so discouraged from not finding a job that they just give up and stop looking for work altogether. Officially such people are called “discouraged”.

That person is no longer “willing” to work. They leave the labor force and join those not in the labor force.

The number of unemployed people drops from 5 to 4, the labor force drops from 80 to 79 and those not in the labor force rises from 20 to 21. Our diagram now becomes the following.

Now calculate the unemployment rate: 4/79 = 0.05 or 5%. The unemployment rate FELL from 6% to 5%!

This is where these definitions matter. The unemployment rate just tells us the percent of people willing to work that can’t find jobs. But when things get really bad, then people get discouraged - lose the will to work - and leave the labor force. All else equal, this drives down the unemployment rate.

The Missing People in the Labor Force

Now we return to those missing 4 million people. The labor force participation rate fell during Covid from 63.4% to 62.1%. Many of those people left the labor market due to concern over Covid and some because they became discouraged.

Just to remind us, the FRED chart for the Labor Force Participation Rate is here.

When Covid first hit, it dropped to about 60% but then bounced back to 61.5% and eventually to 62.1%, where it is today. By July this year, we generally expected all the people concerned with Covid to have returned to the labor force. We have vaccines, boosters, milder variants now, etc.

Maybe the companies still aren’t hiring. A lot of them had trouble and closed their doors leading to what we call “long-term unemployment” which is what we call unemployment longer than 27 weeks.

But the number of people unemployed 27 weeks or more is mostly back to normal as well. See the next FRED graph.

Companies are back. Long-term unemployment numbers returned to normal (i.e., pre-Covid). But not everyone returned to the labor force. That the participation rate is so low remains a mystery.

The important point here is that many people have not yet returned and their absence has driven the unemployment rate down to 3.5%, not the extremely strong economy. If it were the strong economy driving down unemployment, you’d see both the labor force participation rate rising and the number employed rising, leaving the percent unemployment lower. That would all drive up real wages too. But that’s not what we’re seeing.

What “Should” the Unemployment Rate Be

Since we know what the labor force participation rate should be – that is, if it were at its pre-Covid level – then we can figure out what the unemployment rate should be today as well. Now, this is a loose estimate but still a valuable first-pass look at where unemployment should be.

First, consider the labor force. If the population is about 332 million, and 63.4% are in the labor force, then the labor force is about 210.5 million[5] . We know that business are willing to hire about 199 million people at current wages since that’s actually the current employment number. If that same number of people were hired and we were at our normal labor force participation rate, then that would leave 11.5 million people unemployed. The unemployment rate would then be 11.5 divided by 199 which is 5.8%. That’s a very loose, approximate number and in the footnote I give the more precise number[6].

The point, however, is that instead of being around 3.5%, the unemployment rate looks like it should be around, say, 5.5%. Maybe it should be a little more, maybe a little less, but it would certainly be a lot higher than it is now.

And, if you look at the unemployment rate back to 1948, that 5% rate isn’t so far off. Below is the unemployment rate in a FRED graph with a red line at 5%. This merely suggests that my back-of-the-envelope calculations aren’t too crazy.

A few things can throw this off. With more people in the labor force, wages wouldn’t have risen as much, for example. In that case, more people could be hired because they would be much cheaper. But, I think 5-5% is a safe guess as to where the US labor market actually is.

The Bureau of Labor Statistics notes that “The number of persons not in the labor force who currently want a job was 5.9 million in July, little changed over the month. This measure is above its February 2020 level of 5.0 million. These individuals were not counted as unemployed because they were not actively looking for work ...”[7]

If we considered all 5.9 mill in our unemployment calculations, we’d have unemployment of 5.8% exactly. (I got that by adding the 5.9 million to our actual labor force, holding employment constant and then calculating the unemployed number.) So again, my 5.5% or so calculations aren’t too far off.

That means the labor market isn’t particularly weak or strong by historical standards. My guess is that the long-term natural rate of unemployment in the US economy is around 5%, maybe a bit lower but close to 5%.

If the labor market isn’t as strong as we think, then higher Fed interest rates and a slowdown in growth will raise unemployment soon. Company demand for labor isn’t quite as strong as the official 3.5% unemployment rate suggests.

As a final piece of evidence for my weaker-labor-market argument, if demand for labor were strong, pushing unemployment down, I would expect to see wages higher than they are.

Low Real Wages

Real wages have not been rising. They have been been falling. As inflation rises, it eats up more and more of each paycheck a person earns.

Nominal wage growth was reported in the August jobs report to be around 5.5% in June[8]. That’s what it’s been for much of this year.

People’s nominal wages rose by 5.5% but each of those bills bought 9.1% less due to inflation so real wages are falling by about 3.6%. And that’s what the FRED graphs show as well.

One reason not to return to work is that you’ll earn less than you did in the past. A declining real wage scenario discourages people from working.

But lower real wages do make labor relatively cheap compared to other inputs for companies.

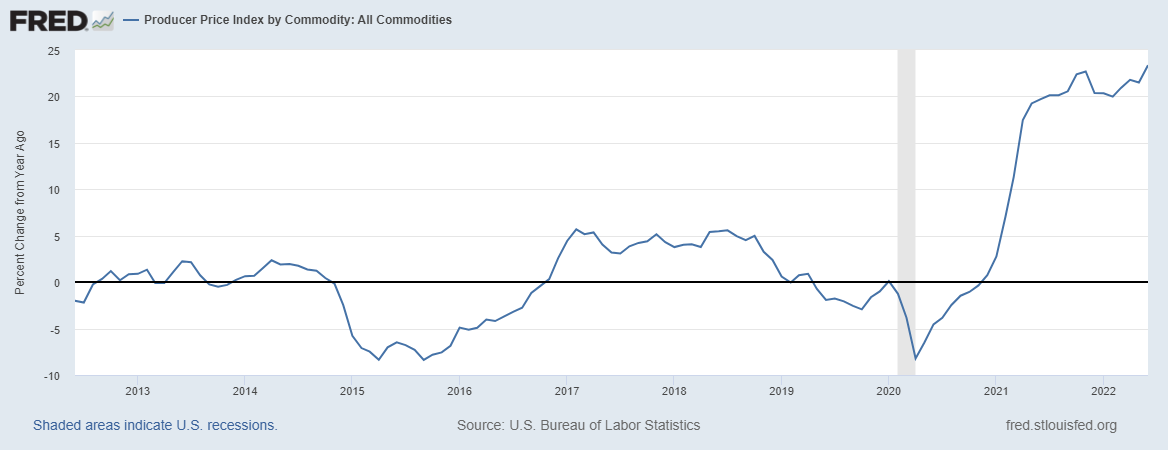

To see that, look at the producer price inflation. That’s the price producers buy their inputs at. Its inflation rate is over 20% today!

The price of all other goods and inputs are rising at 20% or more for companies while their output prices are rising at 9.1%. That means while the real cost of most inputs is rising by 10.9% (i.e., 20% - 9.1%), the real cost of labor is falling about 3.6%. As a result, labor is relatively cheap for companies and so they demand a little extra labor than they otherwise would. But that’s not a sign of a strong economy.

Conclusions

My conclusion is that the actual unemployment rate is more like 5%. Unemployment looks better because people left the labor market and haven’t returned. If demand for labor were really strong, you’d see wages rising more rapidly. But you aren’t.

Nominal wages are rising at about 5% because supply is still restricted and demand for labor is actually a bit weak.

None of this is to discredit the current jobs report. It was good. It was astonishingly good. I’m very glad demand for labor is as strong as it is.

What’s important, however, is not to delude ourselves into thinking the economy is stronger than it actually is because the official unemployment rate looks low.

As the Fed raises rates, demand for goods and services will slow more and, as a consequence, companies will demand less labor. I’m expecting unemployment to get worse in the coming months.

My concern with these numbers is that we are skating on ice thinner than we think and things can turn worse quickly as markets realize this.

[1] “US Jobs Report” is actually the US Bureau of Labor Statics Employment Situation report. You can find the main site here: https://www.bls.gov/bls/newsrels.htm . The summary report everyone is talking about is here: https://www.bls.gov/news.release/empsit.nr0.htm .

[2] We also saw that, for the US economy, the actual the labor force participation rate was 62% in July but pre-Covid it was 63.4%. That means approximately 4 million people are “missing” from the US labor force today.

[3] We measure “willing” in the real world by simply asking people if they have been looking for work or not. If they don’t have a job but are looking for work, then they are considered willing to work and hence unemployed.

[4] The exact numbers are 206,172,00 in the labor force and 7,216,020 unemployed. Divide unemployed by labor force to get the unemployment rate.

[5] Technically, 332 mill times .634 equals 210,448,000 people.

[6] The number above is a little high because I rounded everything. The actual numbers are here: If there are 210,488,000 in the labor force and 198,955,980 are employed, then there are 11,532,020 unemployed since 210,488,000 – 198,955,980 = 11,532,020. The unemployment rate is then 11,532,020 / 210,488,000 = .054787 or 5.48%.

[7] BLS: https://www.bls.gov/news.release/empsit.nr0.htm

[8] BLS: https://www.bls.gov/opub/ted/2022/compensation-costs-for-private-industry-workers-up-5-5-percent-from-june-2021-to-june-2022.htm