USD vs World Exchange Rates Update for April 10 – April 14

By Luke Brown, Quinnipiac Global Economics Research Team

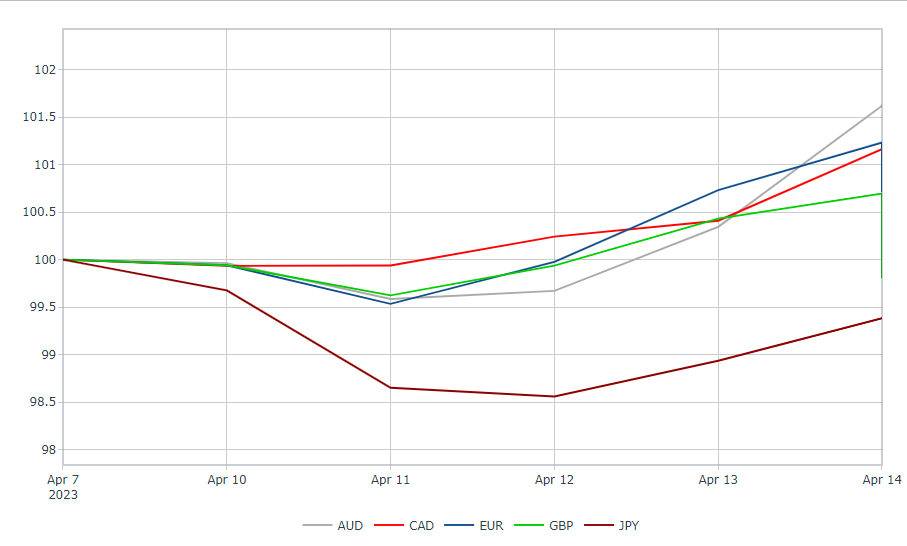

USD vs World Currencies Index

Source: Yahoo Finance and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency) and then indexed to be 100 at the start of the period.

For the week of April 10 - April 14, 2023, global currencies saw some notable fluctuations relative to the USD. All currencies saw a slight dip to begin the week but most bounced back and strengthened. The Japanese yen (maroon) saw a decline of about 0.6%, while all other currencies strengthened. The Australian dollar (gray) gained the most at approximately 1.65%. Similarly, the Euro (blue) saw a significant increase of approximately 1.25% against the US dollar, while the Canadian dollar (red) also strengthened slightly less by approximately 1.2%.

Note: The British pound (green) is shown on the graph as experiencing a positive trend, rising by 0.7%. This is incorrect as it finished the week down 0.2% due to a steep decline late on Friday. We are working on ensuring these types of late changes will be reflected in our graphs moving forward.

USD vs World Historical Trends

Source: Yahoo Finance and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency). The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

For the week of April 10 – April 14, 2023, Japan continues experiencing an inconsistent pattern relatively close to its three-month rolling average. It currently sits just below its three-month rolling average. The Euro (EUR) and British pound (GBP) each continued their strengthening pattern for most of the week, but GBP had a steep weakening to end the week slightly lower than it began. This potential trend reversal may be something to watch moving forward. The Canadian dollar (CAD) has continued to strengthen and currently sits one standard deviation above its three-month rolling average. The most interesting currency this week is the Australian dollar (AUD) which after hovering near one standard deviation below it mean for the past month and a half strengthening to sit just below its three-month rolling average. At the beginning of the month a spike like this occurred but quickly declined back down so we will have to be patient to see if this pattern will repeat itself.