The Price Effects of Hurricanes

Photo by Jonathan Kemper on Unsplash1

When the dock workers went on strike right after Hurricane Helene hit, I received a lot of calls about the likely economic effects. I even wrote a nice column to share with everyone, but as I finished editing it, they announced the strike had ended, so I didn’t release it.

As I listened to discussions about the economic impacts of Helene and now Milton, I was fairly sure someone would simply look at the effects of Katrina, the largest and most damaging hurricane in modern U.S. history, and conclude that the effects of Helene plus Milton would be similar but smaller.

No one did this, at least not that I saw in the news, so I thought I would do it and share.

Economic Basics

All we need to know from economics is basic supply and demand. If the demand for something rises more than the supply of it, then the price of that thing rises. If the opposite happens, and the supply of something rises faster than the demand for it, then the price of that thing will fall.

The second thing we need to keep in mind is how big the market is and how widespread the effect is. Higher local demand will raise local prices but have little effect on the national average price for something. Those higher local prices “call resources” to them. That is, they encourage suppliers to reroute supplies to where the higher prices are, which eventually increases the supply in the local market, and the prices will settle back down2. The broader market is little affected because it’s so vast, and relatively speaking, local demand is tiny.

The Effects of a Hurricane

Applying the above insights, a hurricane that hits and only affects a local area will have local effects, but not national and certainly not global effects. The markets most likely affected are pretty easy to guess.

On the supply side, we expect a drop in the supply of the following: clean water, energy, gasoline, and similar items. That’s because the hurricane will bring down power cables, disrupt gas deliveries, and flooding will pollute clean water supplies, making them unsanitary. Using that same logic, the more the hurricane destroys buildings and infrastructure, the more we might expect local food supplies and other goods to be disrupted as well. So, we’d expect local prices for these things to rise, which encourages suppliers to redirect more supplies to this area.

Those are the immediate effects. Longer-term effects will also come from the destruction—a decrease in the supply—of local buildings. The more destruction there is, the more related prices will rise, assuming the local population stays. If the destruction is severe enough, people may flee the region in search of jobs, and demand for local housing and other goods may also fall.

On the demand side, the effects are generally longer-term. After the hurricane, communities need to rebuild. So, the things destroyed will be in higher demand for a while. These are also easy to guess: wood and other building materials.

Depending on what’s hit, we could expect other goods like clothing and apparel to be affected. If people’s homes and local stores are destroyed, they’ll need clothes just when supply lines are also down. With Katrina, we saw an outpouring of support from Wal-Mart, Home Depot, and others who donated clothes and emergency essentials and then also supplied reconstruction efforts.

Some Katrina Particularities

Some things made Katrina unique. First, it was massive, and New Orleans was already built below sea level with very old infrastructure. So, it was a perfect storm—no pun intended. That meant greater-than-usual damage to homes, clean water, and other essentials.

Second, Katrina hit the New Orleans-to-Houston area, where many oil suppliers enter and leave port. Oil rigs in the Gulf of Mexico were destroyed, ports were damaged, and ships supplying global oil markets were left at sea before and after the storm, waiting for it to pass.

All this is to say, Katrina had a bigger effect on local, national, and global energy/fuels markets than we’d expect from Helene and Milton. There was a demand effect and a large global supply effect that were pretty unique.

National Price Effects of Katrina

I’ll focus on price effects.

It’s not that we don’t care about the cost of these hurricanes in terms of business loss and, especially, the loss of life. It’s only that those things are pretty clear and dominating the news. I add little for you regarding those topics.

Personally, I can’t watch and listen to the stories about family members trapped, dying and looking for kids. For these things, my only comment is that we should all pray for those people and their families and donate to help charities that can help them. And, anyone local should - and most already are - get out and physically help.

For the rest of us, especially in the midst of an insane U.S. Presidential election year, the questions are around what these hurricanes will do to prices and the economy overall.

Katrina hit in August, 2005. Overall inflation was around 2.7% in 2004, 3.4% in 2005, and 3.2% in 2006. So, the national effect was likely zero, or some of it might have pushed inflation a tiny .1 - .2% higher than it otherwise would have been.

I then looked at Consumer Price reports for August, September, October, November and December 2005 to get an idea of the effects. Largely the effects are what you expect: mild effects in August, more effects into September, some into October, and by November things were normalizing.

I only focused on a few items that are most likely to have been affected. The CPI overall did rise in September and October, peaking at 4.7% in September. I averaged these 5 numbers and get 3.9%. If I assume instead that September and October had stayed at 3.6% like August, then the average is only 3.5%. I don’t think the national effect for inflation for the whole year was large.

We don’t see much change in food month to month. I checked “Meats” (technically: meats, poultry, fish, and eggs) and “Fruits” (and vegetables). Looking overall for meats, it’s 0.4 to 1.9, and the 1 in September and 0.9 in October don’t seem like anything special. Fruits did pop up in September, but they were 7% in July, so this instead looks like a blip in a falling trend.

Housing rose and continued to rise. It includes a range of things, including fuel costs, so it is likely driven by factors other than just the supply of the houses themselves. But also, as I’ll note below, this was the beginning of the lead up to the housing crisis, so “housing” as a category continued to increase for the coming years and had nothing to do with Katrina.

Fuels rose dramatically from August to September and remained high. Katrina was unique in affecting world energy supplies, as mentioned above. Transportation costs also jumped significantly and then settled in November. That would also make sense as domestic transportation re-routed from a major port area to other ports.

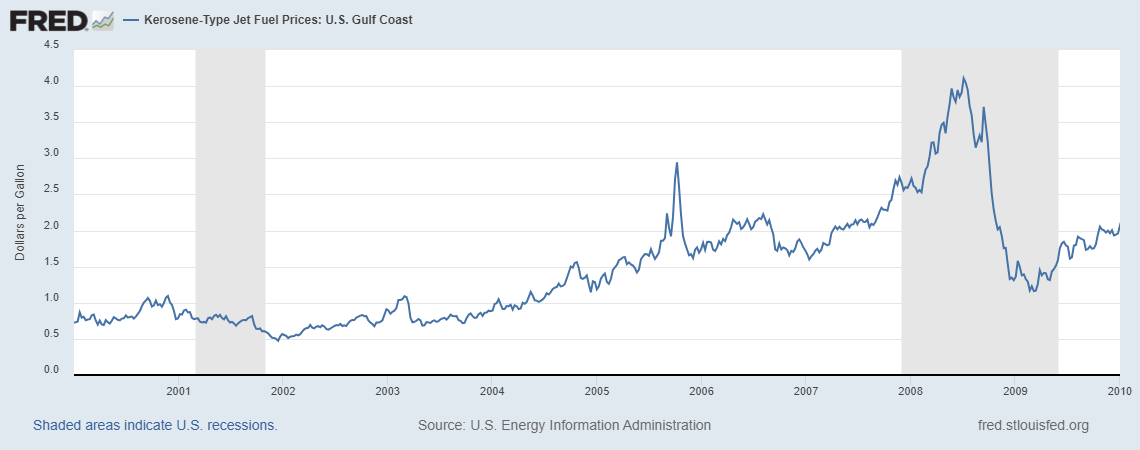

Finally, these two graphs show that there was indeed a spike in kerosene-type jet fuel around Katrina. I checked, and that jump upwards in the graph is indeed around August 2005. We see a similar spike in U.S. regular gas prices. But, interestingly, we see gas continuing upwards until the peak and then collapsing in the 2008 Great Financial Crisis.

It’s an interesting side note that the massive boom in housing markets, which were funded by cheap loans and led to our financial crisis, also appears to have been driving a boom in energy costs. It makes sense, with housing and construction being energy-intensive themselves, and then you need energy for the new homes. There was also a massive “wealth effect” because people felt richer with rising home prices, and this can add to energy demand. But I hadn’t really noticed this before.

Anyway, we can see the price spikes around Katrina, and the other part related to the housing crisis is just tangential to our story today. So, we’ll move on.

2024 CPI and Helene-Milton Effects

When I originally wrote, I was predicting a much larger price impact if the port strikes continued. In that case, we would have had the whole Eastern side of the USA closed off to supplies due to port strikes and hurricanes. And, it would have hit exactly those goods likely in highest demand like wood and housing supplies as well as apparel. But the strike ended after only three days. That will still take about 3 weeks to work itself through the US distribution system3, but the effects of the strike should be negligible.

Today, I expect that those same areas will be affected by Helene and Milton since energy supplies are still disrupted in the hurricane region, but I mean domestic supplies, not supplies to the world like with Katrina. So the effect should be smaller. Those supplies will also be in much higher demand as they reconstruct, and these hurricanes hit huge areas. So I expect to see some effect.

And I actually think it will affect the CPI for the U.S. during this time because, by chance, low energy, fuel, and gas prices are driving our current low CPI numbers. Undoing those means the CPI will rise.

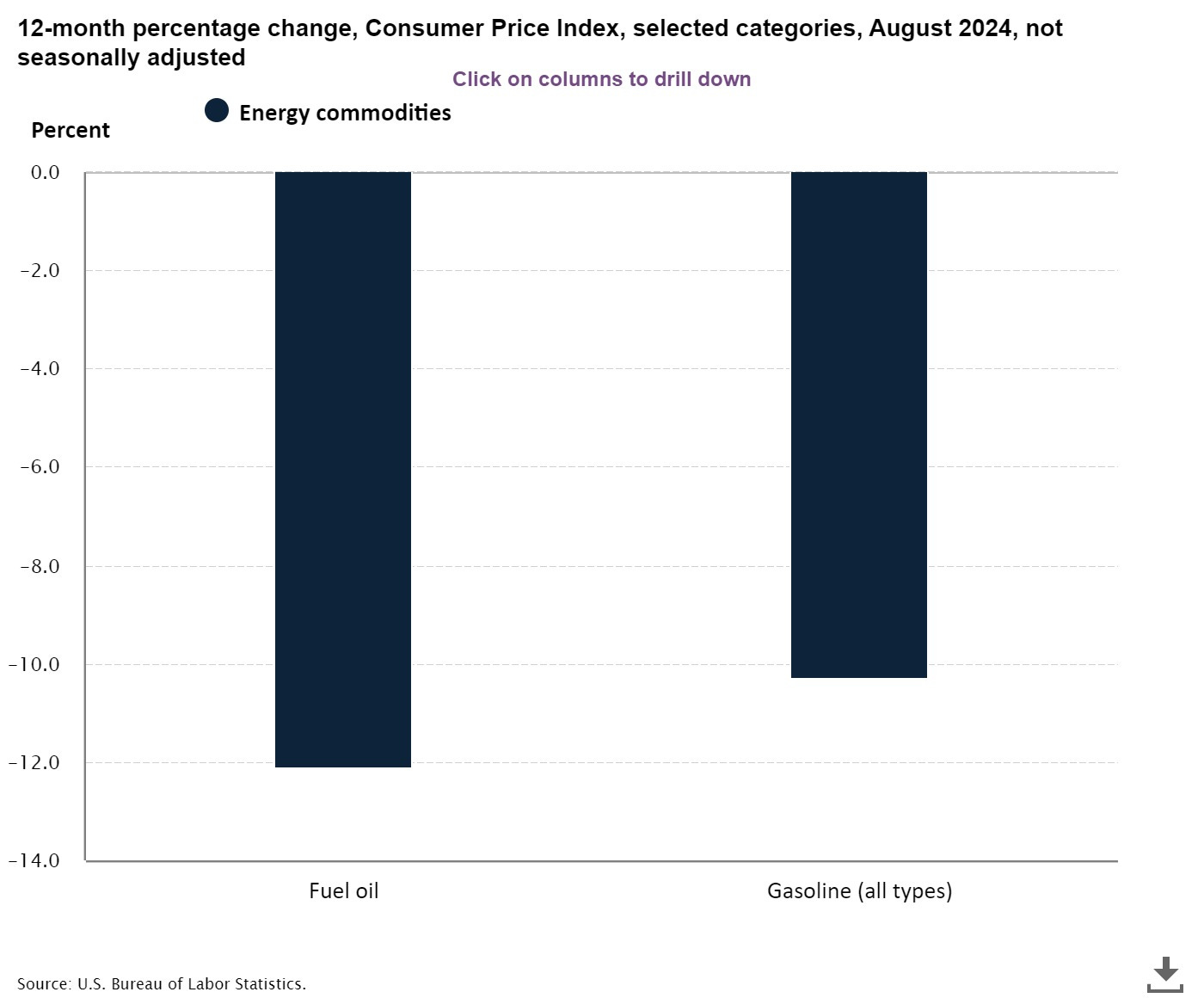

If you look at the prices that fell the most and brought our inflation numbers down near the Federal Reserve’s target of 2%, they are some of these affected areas. They are the likely “shortage” goods mentioned above.

The latest CPI details can be found (here) at the BLS site.

Notice that the big drop is in energy. That is something that should rise in price due to the hurricane. Normally, I might expect that to be a minor blip upward in our CPI number but not enough to derail it for long.

But if we look behind some of the numbers, we see that those areas that fell the most are also the most sensitive to the hurricane and strike effects (which also affect “energy” when you include imported oil, gas, etc.).

This shows that fuel oil and gasoline both dropped by 10-12%, which was an important factor driving down overall energy costs. These should both be affected by the hurricane for sure, as mentioned above.

Some Conclusions

Overall, I expect the price effects to be mild. The human toll is huge. Actually, it is the largest since Katrina. Over the coming months it will be sad to see which regions will not fully recover. Many people lost their lives, lost family members, and lost their livelihoods. Again, pray, donate, and help where you can.

As for broader economic effects, I expect we’ll see and feel some energy costs rise. This is additionally true because there are continuing—and potentially escalating—wars in the Middle East at this same time. While we’ll feel that already now and through October and into November, it’ll likely only appear in official statistics in November.

When it does, I’m expecting to see the CPI rise because the exact prices being affected are those that pulled the CPI down in the first place. Interestingly, because this is clearly a temporary effect caused by the hurricanes, it should subside, and because of that, it should not affect the Fed’s decision to lower rates for inflation reasons.

The other reason the Fed raises or lowers interest rates is due to changes in unemployment. I checked the unemployment rate around Katrina, and there’s no national effect. Therefore, I don’t expect one this time either. But if anything, it would raise unemployment and encourage the Fed to cut interest rates.

So, I think the effects are huge locally and mild nationally, pushing up some prices with a focus on energy-related prices. That can have a political effect because people will feel those prices leading up to the November election.

I think it will not affect the Fed’s decision to cut interest rates by 0.25 points in November. I’d guess that’s about 50:50 at this point since inflation still isn’t all the way down to target, and unemployment is still reasonable.

Thank you for reading.

In the interest of full transparency, this is actually a picture from Germany.

This is, by the way, the reason most economists - including me - oppose anti-price-gouging laws. They stop the market-systems natural healing process by blocking the signals - prices - from doing their jobs.

I read at the time that each day of the port being closed takes 1 week to be cleared out through the system.