Why The Down Dollar?

The US in a Global Context

The U.S. inflation numbers (CPI) came out August 14th. Headline inflation has finally fallen below 3%. That’s really great news! Stock markets rallied. Market interest rates have been falling ever since, easing some of the financial pressure and potentially stimulating the economy. So, why the down U.S. dollar?

The U.S. dollar fell against the Euro to “its weakest since the beginning of the year”, I heard on Bloomberg last week. It weakened against the Japanese yen. It weakened against the British pound, the Canadian dollar and all other major currencies - at least that I checked.

On Aug. 21st, we then learned that the U.S. labor market has been weaker all year than we previously thought (see U.S. Bureau of Labor Statistics, Aug, 21, 2024 update). While adjustments are common, this one was HUGE. It turns out that the U.S. economy generated 818,000 fewer jobs than had been reported over the past 9 months or so. This means the labor market is weak and unemployment is likely higher than the currently reported 4.3%.

Friday (Aug. 23rd), at their annual Jackson Hole Economic Conference, Fed Chair Powell announced publicly that it’s time to start cutting interest rates.

Let me pull that all together to make sense of the weak U.S. dollar.

Back To Basics: Interest Rates Call Funds and Strengthen Currencies

I’ve mentioned this before, but higher interest rates attract global investment funds to the high-interest-rate economy, which increases demand for that economy’s currency, strengthening it relative to others. Lower interest rates have the opposite effect.

Additionally, global investment fund managers trade based on their expectations of whether interest rates will rise or fall. They can make significant profits if they bet correctly. They buy a currency while it’s “cheap,” and if interest rates rise, the currency strengthens, allowing them to sell it at a profit.

The catch is that everyone has access to similar information about potential interest rate changes, so they generally make similar bets. And, if everyone bets today that the currency will be stronger tomorrow, they all try to buy it today, which makes the currency stronger today1!

Currently, most people believe the U.S. Fed will lower interest rates in September. Anticipating this will weaken the U.S. dollar relative to other currencies, they start selling dollars (weakening it) and buying other currencies (strengthening them) today. As in the previous example, this indeed weakens the U.S. dollar and strengthens other currencies.

The Future of U.S. Interest Rates

The basic way to understand how (good) central banks approach changing interest rates is through the Taylor Rule2. The Taylor Rule essentially states that when inflation is above its target or when output (GDP) is above its long-run level (referred to as “Potential GDP”), interest rates should be raised. We've seen this in action over the last three years.

However, until now, these two factors seemed to be moving in opposite directions. Inflation remained above target, while output was slowing to or possibly falling below potential.

Keep in mind that these variables are difficult to measure, and any assessment of "the whole economy" requires months of data collection and statistical analysis. As a result, the Fed examines a broader range of indicators to try to understand how strong the U.S. economy is, with the unemployment rate being one of the most important.

The rule-of-thumb belief is that unemployment around 4% is the U.S. economy’s “natural rate” (i.e., where unemployment would be if GDP were at its potential level). While unemployment crept slightly above 4%, to 4.3%, inflation remained over 3%, still well above its 2% target. Traditionally, you’d like to see inflation around 2.5% to say it’s “close to target”.

As a result, at the last Fed meeting in July, the Fed did not cut interest rates. Seeing that the U.S. was, however, on a slow and steady path toward near-target inflation and slowly rising unemployment, they guesstimated that by September the numbers would justify a rate cut.

Soon thereafter, on August 14th, the inflation numbers came out at 2.9%. This was below 3% sooner than expected, suggesting that we are moving toward the target faster than anticipated.

This news already suggested to market participants that the Fed was more likely to cut in September. Imagine that originally they gave it a 50% chance. This good inflation report moved it up to, say, a 60-70% chance they’ll cut.

That increase alone was enough for global currency traders to start moving out of U.S. dollars in anticipation of a September rate cut.

This week, with the jobs update showing that the labor market—and hence likely GDP—was weaker this year than originally thought, the probability of a rate cut surged among traders. My guess is that many now assume it's 100% certain and are instead focusing on how large the cut will be and how many more might follow this year.

Indeed, those traders' assumptions were correct. Fed Chair Powell just confirmed it publicly, removing any remaining doubt.

Market Reactions

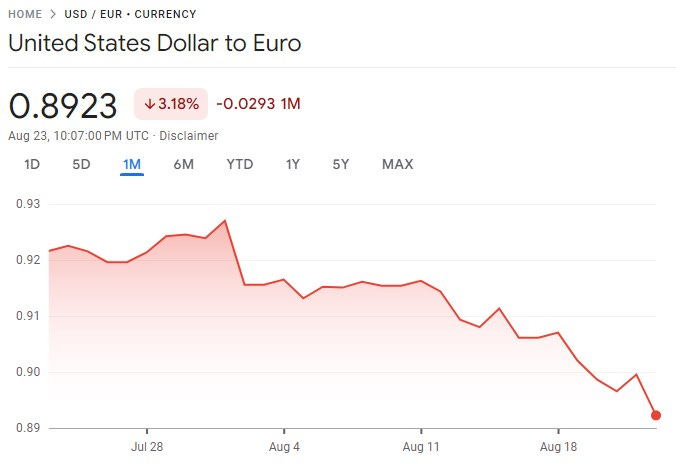

Here’s the U.S. dollar to Euro exchange rate (it shows how many Euros 1 USD buys, so a decline represents a weaker U.S. dollar) over the last month. You can see speculation starting at the end of July with a drop—that’s when they likely increased the initial likelihood of a September rate cut. August 14th (when the CPI numbers were released) isn’t marked, but you can see the slide beginning around August 11th as suspicions grew. The upward blip occurs on August 15th and likely reflects heavy trading in currency markets on that day. Then it declines, and finally, you see it dropping this week with the new jobs numbers and, ultimately, Chair Powell’s announcement.

Graph from Google Finances (link).

But, lest you doubt that global traders were watching Chair Powell’s comments Friday, here’s the graph for just Friday. His announcement was around 2:00 PM EST (see WSJ story on this). Pretty clear reaction.

Graph from Google Finances (link).

(By the way, the USD versus most currencies look like these graphs.)

Will the Dollar Continue to Decline All Year?

No. It strengthened a lot over the last few years as the U.S. Fed raised rates faster and higher than other countries, like the Europeans. So, some re-adjusting will take place.

Interestingly, the Europeans have already been cutting interest rates. They cut rates in June from 4.5% to 4.25%. So did the Canadians, cutting from 5% to 4.75% in June and again to 4.5% in July. As did the UK, taking their rates from 5.25% to 5% on August 1st.

Nevertheless, the USD weakened against all those currencies too. I suspect that is because market traders (a) expect this Fed cut to be a big cut, (b) as the last country to cut rates, it’s also a signal that, indeed, the time for declining world interest rates is upon us, and (b) the U.S. is the global economic giant. When we cut rates, it rocks the world economy. Our currency is the global reserve currency. It’s the basis for most global trade. So, our cut has a bigger effect.

All that being said, it’s a bit surprising to me. Despite our U.S. economic slowdown, our economy still seems to be stronger than most economies in the world. If true, and if it remains true, it should drive up U.S. dollar demand regardless of interest rates.

Expectations and Beliefs are Slippery Things

We are right now in a world dominated by guesses and conjectures about the future. That suggests we are in very turbulent times. During such times, things sensitive to expectations, like exchange rates and stock markets, move in sudden and erratic ways.

Whether the U.S. will enter a recession or not will be a question of growing importance. The more likely a recession, the more likely we’ll see rate cuts, but slower U.S. economic growth also means a global recession. When the world is in recession, the U.S. is the safe haven to park your money. So… buy USD or not? Hmm.

Will the Fed cut once? Will it be a big one time cut and then nothing. Or, will they start small and then maintain regular cuts? If a big cut, the USD drops now (i.e., sudden weakening of the currency) and recovers slowly later. If several small, regular cuts, then we’re more likely to see a slight weakening in the USD relative to other currencies that persists for longer.

Who wins the U.S. Presidential elections? In June it was clearly Trump (especially after the Trump-Biden debate). Today, it looks neck-and-neck. Every trader has their own views on whether Trump or Harris will be better or worse for the U.S. economy, better or worse for the world economy and so on. That means they each have their own beliefs about (a) who will win and (b) whether that’s good or bad. You couldn’t ask for more turbulent times, at least for currency markets.

We will see a few things more clearly over the coming months. We’ll see the Fed’s rate cut at their September 17-18 meeting. We’ll also get more economic reports by then.

The polls and estimates for the U.S. election will come in ad nauseum until the actual election on November 5th. By then, however, we’ll have a much better sense of where the U.S. economy is and where interest rates are.

So, as I see it, September will answer some Fed interest rate questions (big cut, small cut, how does Chair Powell see things) and give us more signs about a recession or not. October and the first week of November will be all about politics…ugh.

Buckle in. I think it’s going to be a wild ride for the coming 3-4 months. My guess is that the U.S. dollar will weaken and remain weak for the coming 6 months. Beyond that, your guess is as good as mine.

Thank you for reading!

PS. I wanted to suggest you check out the comments sometimes. I don’t get a lot, but the ones I do get are quality…thank you! After my piece on lowering government debt, Wasserschweinchen, commented: “Sweden is another success story. In 1996, it was decided that the budgeting process should be made stricter, one of the new rules being that there must be a one third of a percent of GDP surplus on average over a business cycle. Since then, government debt has gone from over 70% to less than 20% of GDP.” Excellent point and totally right. Thank you!!!

And, I like to point out to my students that, everyone’s bet was right! They pushed up the value today and when tomorrow comes, it is indeed stronger than it was when they all started.

See Atlanta Fed’s Taylor Rule tool to read about and see it’s actual predictions based on current Fed data. Scroll down and click the “Chart” Icon to see a chart of where interest rates “should be” based on the Taylor Rule versus where they are.